I’ve made many pointed comments about Pemex, Mexico’s staggering state-owned oil company, as well as written a post or two dedicated to the company. I’ve been challenged, or at least questioned, by some readers about my comments. The latest was by reader Petzcuaro Dave. I had written that Pemex wells were running dry. Dave sent me a link to a Pemex website which would seem to negate my statement. He asks for my sources.

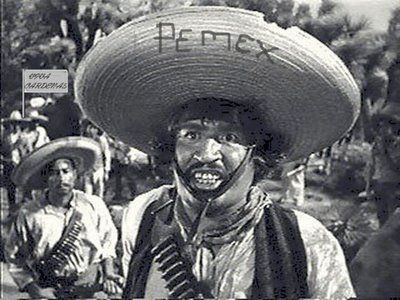

I don’t have to show you any stinkin’ sources.

I thought it might be useful to delve into this Pemex business a bit deeper So, here goes.

First of all, let’s take a look at what international oil production means to us. Last year, the world extracted just about 1 cubic mile of oil. That’s about 26.22 billion barrels at the 42 gallon/barrel US standard. If, as some experts and all the greenies predict, the world will essentially run out of oil in the next 50 years, here is what the world would have to do, starting right now, to replace that cubic mile of oil over the next 50 years.

The world would have to design, build and launch, beginning right now and continuing every year for the next 50 years:Now, I’m not sure how the authors of the above intend to use energy from, say, the wind turbines to produce plastic. That technology doesn’t yet exist and may never exist. Look around your house. Try to imagine it with no plastics content. Your computer, telephones, TV’s would all disappear. No cables or wiring would have any insulation. Your car would be gone. Airplanes would be too heavy to fly. You’d have no nail polish remover. Your roof would leak for lack of shingles. It is really unimaginable.

104 coal fired plants -- every year for 50 years = 5200 plants

or

4 dams the size of the massive Three Gorges Dam on the Yangtxe River in China -- every year for 50 years = 200 gigantic dams

or

32,850 wind turbines per year -- every year for 50 years = 1,642,500 turbines

or

91,250,000 solar panels -- every year for 50 years = more than 4.5 billion panels

or

52 nuclear power plants -- every year for 50 years = 2600 nuclear plants

Let’s just say, for the sake of keeping this argument simple, that we need oil, we need it badly, and that need is not going to disappear in the foreseeable future.

So, we need oil supplies. And countries, such as the third world country from which I write, need the income from that oil.

So what is Pemex doing to assure that it can not only supply as much oil as possible but also maximize the income to the Mexican people? Not too much. Before I continue any further, let me emphasize that, when I talk about Pemex, I’m really talking about the government of Mexico, since it is the sole owner of Pemex.

Pemex was formed after 1938 when President Lázaro Cárdenas nationalized Mexico’s oil industry. When a government nationalizes its oil industry, that means that the government steps in and confiscates all of the equipment, drills, pumps, buildings, refineries, vehicles, ships, airplanes, offices, records, bank accounts etc. of the private companies to which that same government had previously sold leases and other rights.

In other words, the government sells licenses to various foreign investors to attract them to invest billions of dollars, then steps in and steals it all. In almost all cases, the government blames the foreign companies, and often the foreign governments, for "robbing" the people’s energy inheritance. Except, of course, when a US company is involved, in which case the local government always blames the US government.

And, frequently, America gets blamed even when there are no US companies involved at all. In Bolivia, the Bolivian Gas War was brought on by a minority group’s charge that the United States was absconding with the Bolivian people’s natural gas inheritnce. But the companies that had extraction rights are all European companies. If an American energy company wanted Bolivian gas, it had to buy that gas from and pay market prices to a European energy company that was extracting that gas. Oh well.

When a company’s property is stolen by a foreign government, there’s not much the company can do except go to its government and ask for help. That’s what a lot of companies had to do in 1938, like, 17 of them. And both the US and Great Britain responded. They boycotted Mexican oil. The only customer Cárdenas could find for Mexico’s oil was Adolph Hitler. And the Nazis couldn’t buy enough to replace the Americans and the British.

Mexico was drowning in oil and going bankrupt. The US and British governments were demanding hundreds of millions of dollars in reparations for the private property that was stolen and the contracts that were paid for and then shredded by Cárdenas. Mexico didn’t have the money.

Then, along came WWII. Oops. Now the US and Britain needed Mexico’s oil. The poker game started. The US and Britain told Cárdenas they’d return to buying Mexican oil only if he agreed to a reparations payment schedule. The bluff worked because Mexico was running out of cash.

Cárdenas had to sign an agreement which put Mexico deep into debt, a national debt which it has never been able to erase. But the oil began to flow again to the north and the east. In order to even make the initial down payment on the reparations debt, Cárdenas had to beg the Mexican people to help. Tens of thousands of people came forward with donations of cash, jewelry and other personal property to help. That may be why, today, Mexicans abhor the thought of any foreign investment except under such onerous conditions that no foreign investors in their right minds can accept.

So the Mexican government and a whole slew of Mexican governments since 1938 have had control of the Mexican oil industry through a government controlled company called Pemex. You know how that had to go. Badly. And it has.

These governments have, year after year and decade after decade, used Pemex as a private funding source. It is estimated that Pemex loses a cool billion dollars a year just to internal corruption.

All of that corruption has little to do with oil extraction or oil availability or oil reserves. What it does do however, is cause gasoline at Pemex gas stations -- the only ones allowed here -- to cost the Mexican consumer about $1.00 per gallon more than that same oil costs once it is shipped to the United States. At an Exxon station in Laredo, Texas, you pay $1 per gallon less for gasoline than you do at a Pemex station just a couple of miles to the south. And that’s for gasoline produced from oil from the same Mexican well.

What that corruption also does is bleed money away from Pemex that should have been reinvested in the company. That loss, along with the Mexican government’s skimming off 60% of all Pemex revenue to pay for all the sub-standard public services that the bloated Mexican constitution guarantees to the Mexican citizens, leaves no money for exploration or drilling for new sources or the technology development necessary to tap those new sources nor even enough to maintain its existing facilities.

That lack of investment in simple maintenance has led to the frequent and disastrous spills, fires, explosions, sinkings, injuries and death, not to mention the environmental catastrophes.

A key number which all US companies watch very closely is the "reserve-to-production replacement ratio". US companies keep that ratio at 100%. This means that a company must have oil in reserve, that is, located but not yet being tapped or oil that remains in deposits that are being tapped, equal to that which it is currently extracting.

Pemex’s reserve-to-production replacement ratio is only 9.6%. That means that for every barrel of oil Pemex removes from its deposits, it only knows of 1/10th of a barrel with which to eventually replace that barrel. In other words, Pemex is running out of oil. Exxon, on the other hand, already has under lease a full barrel of oil to replace every barrel it currently extracts.

Companies must continue to explore and drill test wells to locate and prove new reserves. That costs billions and billions of dollars. Money that Pemex does not have and cannot borrow because its current debt is already a staggering 45 billion dollars.

The Pemex oil field at Cantarell, the second largest in the world after the Saudi’s huge deposit, is going dry. Pemex estimates that Cantarell’s production will fall by an average of 14% per year. That, along with the falling price of oil, spells economic disaster for the country.

And Pemex’s already bleak forcast may be too optimistic to be believed. In 2005, Pemex estimated that 2006 production from Cantarell would be 1,905,000 barrels per day. In fact, up until October of 2006, daily production from Cantarell averaged only 1,778,000 barrels per day. In October, that number dropped even more to 1,653,000. At $26 per barrel (that’s all Mexico gets paid for its heavy Maya crude because of its low quality), that’s an economic blow to the Mexican treasury of $6,552,000 US per day, 2.4 billion dollars this year.

Now, Mexico knows of other deposits. But they aren’t all they’ve been cracked up to be, either.

Pemex reported that it had over-estimated reserves in the Abyssal Plain by 53 percent, making exploration in that area no longer economically viable. In other words, "Poof!" It’s gone.

Pemex’s other proven reserves, the Ku-Maloob-Zaap (KMZ) complex further out in the Campeche Sound, and the Chicontepec deposit off Veracruz, present technological challenges that Pemex cannot overcome. Only the American companies have invested billions in the technology required to extract this oil. Pemex lacks the technology, the engineering expertise and the money to get this oil.

So Mexico is up against a wall. Pemex is running out of oil and doesn’t have the money or the credit to try to replace it. Only foreign companies have the resources available. But Mexico will not allow direct foreign participation in its petroleum industry.

Populist (read; socialist) politicians like AMLO have declared that Mexico will not allow that direct foreign investment, saying, "That’s not for us."

Pemex is headed towards bankruptcy. The company (the Mexican government, really) is 45 billion dollars in debt with 88 billion in total liabilities. Its revenue stream is only 77 billion annually but 60% of that gets skimmed off and sent directly to Mexico City and another billion gets lost to corruption. Its output is dropping by more than 14% per year and it can only replace 9.6% of what it is extracting. It knows of other possible reserves but lacks the technology and the money to prove them, let alone begin extracting. It needs to drill 20,000 new wells to replace its fading ones and that is more than it has drilled in its 70 years of existence.

Felipe Calderón is no fool. He can see what is happening and where it is all leading. He has gone to Congress and gotten some assurances that Mexico will modify its laws to allow some foreign invstment. But he has not yet put that to the test and he has not yet had to face AMLO’s mobs in the streets.

We’ll see what he does.

for art, gifts and collectibles -- all hand made

by Mexican indigenous artists.

Thanks!

TAGS: Oaxaca, Mexico, Oaxaca teachers strike, Pale Horse Galleries, gifts, collectibles, Mexican arts and crafts, Pemex, Canterell

1 comment:

watch all spanish daramas here in HD quality ·doramas flix

Post a Comment